Accounting rules determine the number of periods and percentage of total revenue to record in each accounting period. You can use accounting rules with transactions that you import into Receivables using Auto-Invoice and with invoices that you create manually in the Transaction windows. You can define an unlimited number of accounting rules.

Invoicing and accounting rules let you create invoices that span several accounting periods. Accounting rules determine the accounting period or periods in which the revenue distributions for an invoice line are recorded. Invoicing rules determine the accounting period in which the receivable amount is recorded.

You can assign invoicing and accounting rules to transactions that you import into Receivables using Auto-Invoice and to invoices that you create manually in the Transactions window.

Here we use both Accounting Rules and Invoicing Rules in combination.

There are 4 types of Accounting Rules.

1. Fixed Schedule

2. Variable Schedule

3. Daily Revenue Rate, All Period

4. Daily Revenue Rate, Partial Period

and

There are 2 types of Invoicing Rule

1. In Arrear

2. In Advance

Now we create 2 cases in which 1st case will be with Fixed Schedule Accounting Rule and In Arrear Invoicing Rule and 2nd case will be with Fixed Schedule Accounting Rule and In Advance Invoicing Rule.

In rest of the cases accounting will remain same only amount calculation will be different for each month which will be explained in the last.

Case 1: Fixed Schedule - In Arrear

First we create Fixed Schedule Accounting Rule.

Here we are creating 3 Month Fixed Schedule Rule with Period Type which we have taken in our GL Calendar. After specifying the number of period system will automatically distribute the percentage on the basis of number of period taken.

Now we create AR Invoice with both rules.

when you select any Invoicing rule then a field in Rules tab becomes mandatory in which you have to take your accounting rule.

Here select your rule and specify the date in which you want your recognition to be placed and the Save.

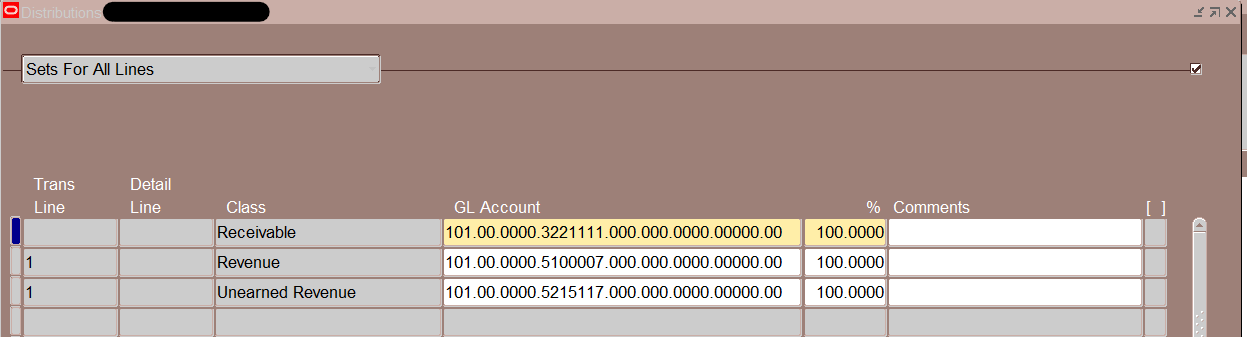

Before completing the invoice check distributions, in which you can see the code combinations for receivable and revenue but there is no amount mentioned because of the accounting rule.

For bifurcation of amounts complete the invoice and then we need to run Revenue Recognition program which will distribute the amount on the basis of Accounting and Invoicing Rule in different months.