Govt. Notification - Finance Act, 2021 inserted a new section 194Q in the Income-tax Act 1961

(hereinafter referred to as "the Act") which takes effect from I st day of July, 202 I. It applies

to any buyer who is responsible for paying any sum to any resident seller for purchase of any

goods of the value or aggregate of value exceeding fifty lakh rupees in any previous year.

The buyer, at the time of credit of such sum to the account of the seller or at the time of

payment, whichever is earlier, is required to deduct an amount equal to 0.1 % of such sum

exceeding fifty lakh rupees as income tax.

Setup Steps in EBS are as follows:-

- TDS Section addition in Asia/Pacific Localization Lookups & Purchasing Lookups.

- Value addition in value set assigned to Natural Account in 'Chart of Accounts'.

- Supplier Site addition in supplier 'TDS Authority'.

- Tax Type Creation for new Section.

- Tax Rate Creation.

- Tax Category Creation.

- Withholding Threshold Creation.

- Third Party Creation.

STEP 1 :- TDS Section addition in Lookups

Navigation:- Financials India--Asia/Pacific Lookups

Purchasing Lookups

Navigation:- Oracle Purchasing--Setup--Purchasing--Lookup Codes

STEP 2 :- Value Addition in Chart of Accounts

Navigation:- General Ledger--Setups-Flexfields--Key--Values

Query the Value Set which is assigned to the natural account in COA.

Here we add 2 values in our chart of accounts, which are shown as below

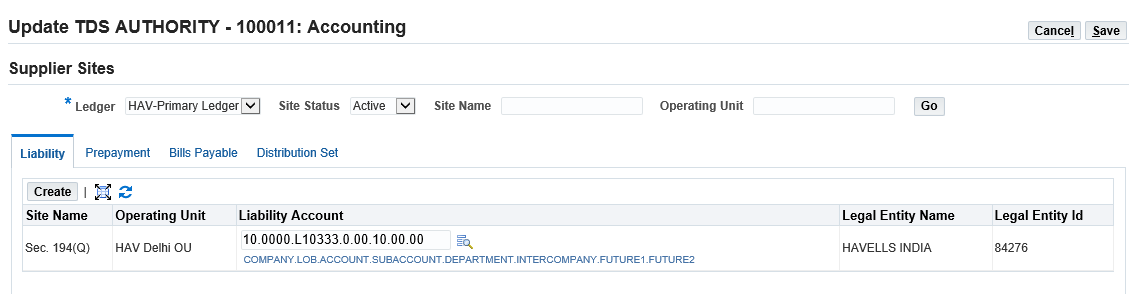

STEP 3 :- TDS Section addition as a site in Supplier 'TDS Authority'

Navigation:- Payables--Suppliers--Entry

Here we create new sites for Section 194(Q) as shown below.

Now go to accounting tab and change the liability account to 'TDS Payable-Purchase of Goods'

STEP 4 :- Tax Type

Note: Some business create different TDS Sections in Tax Type and some create common, so perform this setups after analyzing the business scenario properly.

Navigation:- Oracle Financials--Tax Configuration--Define Tax Type

STEP 5 :- Tax Rate

We create 2 tax rates under TDS Section 194(Q), which are 0% for below 50 lakhs and 0.1% for above 50 lakhs.

Navigation:- Oracle Financials--Tax Configuration--Define Tax Rate

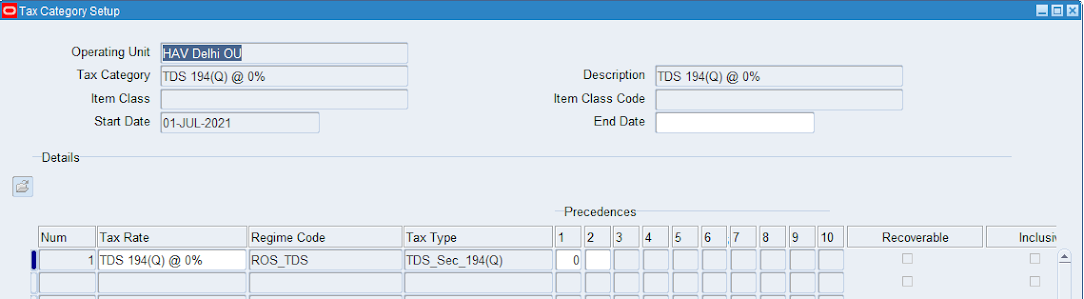

STEP 6 :- Tax Categories

Navigation:- Oracle Financials--Tax Configuration--Define Tax Categories

STEP 7 :- Withholding Thresholds

Navigation:- Oracle Financials--Withholding Tax Setup--Define Withholding Thresholds

Note: As per Govt. Notification, TDS 194(Q) is applicable 0% when purchase from a supplier is up-to 50 lakh and 0.1% if purchase exceed 50 lakh.

STEP 8 :- Third Party Registration

Navigation:- Oracle Financials--Party Registration--Define Third Party Registration

#oracler12 #ebs #oraclefinancials #payables #tds #withholdingtax #withholdingthresholds #tdssection #ofisetups

Very informative

ReplyDelete